Use Case Enrichment and Refinement

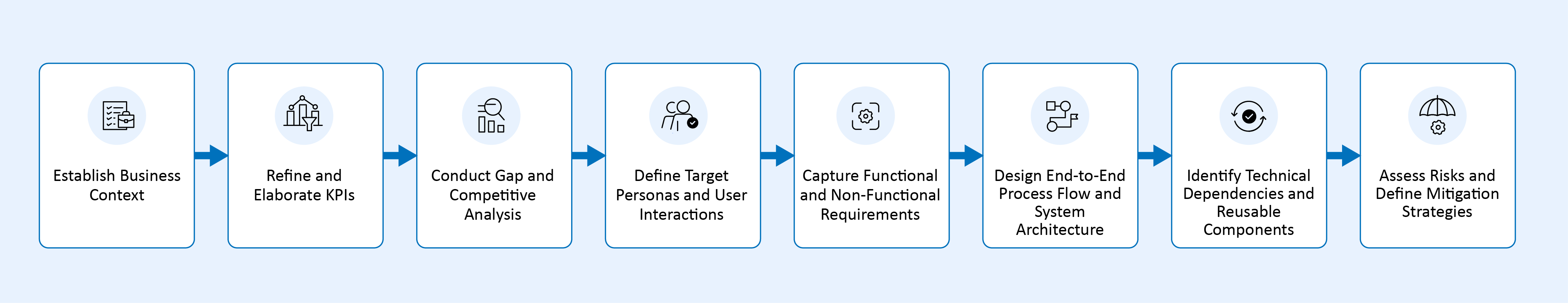

The Use Case Enrichment phase translates a validated idea or business asset into a comprehensive and actionable blueprint. This stage bridges the gap between high-level ideation and development readiness by defining the complete scope of business, functional, and technical requirements. It ensures the solution is feasible, user-centric, and aligned with organizational strategy and architectural principles.

The objective is not just to document a use case in more detail—but to make it execution-ready. This ensures that implementation teams (developers, data engineers, architects, QA, etc.) receive well-scoped, validated, and context-rich inputs—minimizing ambiguity and rework during development.

This phase is also where cross-functional collaboration hits its stride. Product owners, data engineers, solution architects, and business analysts work together to define how the solution will work, what needs to be built, who will benefit, and why it matters.

By the end of this phase, the use case should be fully reviewed by all stakeholders and ready for handover to implementation teams.

|

Goals |

Outcome |

|---|---|

|

A comprehensive solution blueprint, including architecture, process workflows, and integration points. Fully documented functional and non-functional specifications, mapped to business objectives. Defined data structures, APIs, and system interfaces ready for handoff. Embedded scalability, security, integration, and compliance considerations in design. Validated problem statements, opportunity areas, and value hypotheses. Formal stakeholder sign-off, ensuring the use case is ready for development. A comprehensive documentation package that enables a smooth transition to the design and build stages.

|

Practical Guidance for Enrichment

Here’s a step-by-step approach to help teams effectively enrich their use cases using the example of the Customer Sentiment Analysis Use Case. Use the Calibo Use Case Enrichment Template and fill in all the required fields for your use case. Refer to the completed example in the template.

-

Clearly articulate the problem you’re solving. Use real-world pain points.

-

Tie the solution to strategic business initiatives.

-

Define target outcomes: What will change if this use case succeeds?

For example,

-

Business Problem: “Our product managers lack real-time insight into customer feedback across app and website channels. This delays fixes and erodes customer satisfaction.”

-

Strategic Alignment: “Supports our Digital Customer Experience Strategy and Product Optimization Roadmap.”

-

Target Outcome: “Near real-time sentiment dashboard to empower faster, data-driven decisions.”

Use a combination of leading (predictive) and lagging (performance) indicators. For example,

|

KPI |

Target |

|---|---|

|

Customer Sentiment Accuracy

|

≥ 90% |

|

Negative Feedback Turnaround Time |

< 24 hours |

|

Product Improvement Cycle Time |

< 2 weeks |

|

NPS (Net Promoter Score) |

+10% YoY |

-

Identify what's broken or missing in the current system.

-

Compare against peer organizations or industry benchmarks.

-

Ask: "What are others doing that we aren’t?"

For example,

Current Gap: “Manual review of app store and web reviews is inconsistent and slow.”

Benchmark: “Peers are using ML pipelines for real-time sentiment scoring and live product feedback loops.”

-

Who uses the system? What do they do?

-

Capture roles from product, data, engineering, compliance, and operations.

For example,

|

Persona |

Role |

Interaction |

|---|---|---|

|

Product Manager |

Decision Maker |

Monitors sentiment dashboard, prioritizes fixes |

|

Data Engineer |

Builder |

Sets up the ingestion pipeline and data cleaning |

|

Data Scientist |

Analyst |

Trains sentiment model, tunes classifiers |

|

CX Analyst |

Reviewer |

Interprets sentiment trends |

|

Front-End Developer |

Developer |

Builds the review insights dashboard |

Document what the system must do and how it should perform.

For example,

| Functional requirements |

|

| Non-functional requirements |

|

-

Sketch the data flow and system interactions.

-

Use diagrams or swim lanes to show who does what and where the data moves.

For example,

1. Extract customer reviews → 2. Clean & preprocess data → 3. Apply ML model (for example, Random Forest or SVC supported in Calibo Digital Innovation Sandbox) → 4. Score sentiment → 5. Store in analytics DB → 6. Visualize via dashboard → 7. Alert if sentiment drops

-

What systems, APIs, platforms, or frameworks are needed?

-

Are assets available in the Asset Repository?

For example,

-

Data Ingestion: Python pipelines via Calibo Innovation Sandbox

-

ML Models: Pre-trained classifiers (Random Forest, Support Vector Classifier)

-

Storage: PostgreSQL or Amazon S3

-

Dashboard: React-based UI

-

CI/CD: Jenkins for automation

-

Secrets Management: AWS Secrets Manager

-

Be honest about potential blockers.

-

Offer mitigation steps upfront.

For example,

|

Risk |

Mitigation |

|---|---|

|

Low-quality reviews or noise |

Apply filtering + relevance scoring |

|

Model bias or drift |

Regular model retraining + fairness audit |

|

Regulatory exposure (PII) |

Anonymize reviews, enforce data masking |

Customer Sentiment Analysis is no longer just an idea now. It has become a well-scoped use case, with stakeholders, systems, outcomes, and risks clearly mapped. This enriched blueprint can now flow into the Design and Build phases with minimal friction.

PRO TIP:

-

Clarity drives execution. Don’t just list features—tie them to business outcomes, KPIs, and user personas. The more precise you are with functional and non-functional requirements, the less friction you’ll face in design and development.

-

Don't delay discovery of edge cases or system constraints—build them into your enrichment.

-

Use real user journeys and example data flows to validate assumptions with stakeholders.

Checklist for Readiness

Here's your checklist for the Enrichment phase. This acts as a critical quality gate to ensure that all foundational elements of a use case are fully fleshed out before it moves forward into the Design phase. Each item in the checklist serves a specific purpose to validate completeness, feasibility, and alignment with business goals.

|

Sl. No. |

Item |

Status (Y/N/NA) |

Comments |

|---|---|---|---|

|

1 |

Business problem clearly defined |

Y |

|

|

2 |

Target outcomes and goals articulated |

Y |

|

|

3 |

KPIs identified |

Y |

|

|

4 |

Functional and non-functional requirements captured |

Y |

|

|

5 |

Personas and roles identified |

Y |

|

|

6 |

Process flow diagram created |

Y |

|

|

7 |

Data flow and system interfaces outlined |

Y |

|

|

8 |

Gap analysis completed |

Y |

|

|

9 |

Risk mitigation strategies defined |

Y |

|

|

10 |

Enrichment documentation completed |

Y |

|

|

11 |

Stakeholder sign-off received |

Y |

|

|

12 |

Approved for Design phase |

Y |

|

With the Rationalization phase complete, Priya Sharma (Product Owner) and Manisha Verma (Solution Architect) brought together key stakeholders from product, data, and compliance for a series of enrichment workshops.

There were lively discussions—differing views on priorities, feasibility, and KPIs—but this collaborative deep dive helped align everyone. Using Calibo’s Use Case Enrichment Template, the team transformed five shortlisted ideas into fully detailed, implementation-ready blueprints.

Here’s how they enriched each high-potential use case:

| Use Case Title | Use Case ID | Enriched By | Date | Business Function / Domain | Business Problem | Objectives & Value Proposition | Target Outcomes | Key KPIs / Metrics | Strategic Alignment | Current Gap | Competitive Benchmark | User Personas and Interactions | Functional Requirements | Non-Functional Requirements | Process Flow & System Architecture | Technical Dependencies | Risk & Mitigation Plan |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sentiment Analysis of Customer Product Reviews | UC-001 | Priya Sharma | 13-May-25 | Customer Experience / Product Management | Inability to analyze large volumes of customer reviews leads to delayed product improvements and missed insights. | Automate sentiment analysis to provide real-time insights for product teams, improving customer satisfaction and responsiveness. | Faster feedback cycles, higher CSAT scores, improved product-market fit. | • Sentiment accuracy ≥ 90% • CSAT uplift ≥ 15% • Manual analysis reduction ≥ 70% | Aligns with customer-centricity and real-time feedback strategy. | Manual processing is slow and inconsistent. | Leading fintechs use ML-based sentiment dashboards. | Product Manager- consumes sentiment reports Data Engineer - maintains pipeline CX Analyst- interprets trends. | Automated review scraper, NLP engine, dashboard visualizer. | Accuracy ≥ 90%, latency < 5 sec, scalable to 1M+ reviews/month. | Ingestion ? NLP Sentiment Engine ? Visualization Dashboard | Python, NLP Libraries (spaCy, NLTK), React.js dashboard, SQL DB | Risk: Biased models – Mitigate by continuous model tuning using diverse datasets. |

| Real-Time Fraud Detection using Behavioral Signals | UC-002 | Priya Sharma | 13-May-25 | Fraud Management / Risk & Compliance | Delayed fraud detection causes financial loss and customer distrust. | Use behavioral analytics and ML to flag anomalies in real-time, preventing fraud before it impacts customers. | Reduced fraud losses, real-time alerting, improved compliance. | • Detection Accuracy ≥ 95% • False Positives ≤ 5% • Response Time < 500 ms | Supports fraud prevention roadmap and regulatory readiness. | Rule-based system misses dynamic fraud patterns. | Top banks use streaming AI platforms for fraud detection. | Fraud Analyst- reviews flagged alerts Data Scientist -builds models Compliance Officer- audits cases. | Real-time ingestion engine, ML scoring engine, alert dashboard. | Uptime ≥ 99.9%, latency < 1 sec, fault-tolerant streaming. | Stream Processor ? ML Model ? Alert System | Kafka, Spark Streaming, Python (sklearn), Kibana | Risk: False positives – Mitigate by periodic model retraining with labeled datasets. Advance Bank Enriched Use Cases |

| Credit Scoring Engine using Alternative Data | UC-003 | Priya Sharma | 13-May-25 | Credit Risk / Loan Underwriting | Traditional scoring models exclude borrowers without credit history. | Use alternative data like utility bills and mobile usage to assess creditworthiness. | Greater financial inclusion, higher loan disbursement rates. | • Approval Rate ≥ 25% • NPA < 3% • Model Accuracy ≥ 88% | Enables digital lending and expands customer base. | Lack of inclusive scoring models. | Fintechs use telco and utility data for inclusive lending. | Credit Officer -validates scores Data Scientist- designs scoring model. | Alt data ingestion, feature engineering, risk scoring model. | Explainability, FICO compliance, bias mitigation. | Data Collector ? Scoring Engine ? Credit Decision API | Python, XGBoost, Flask API, MongoDB | Risk: Regulatory scrutiny – Mitigate by using explainable AI models. |

| Automated Regulatory Compliance Tracker | UC-004 | Priya Sharma | 13-May-25 | Risk and Governance / Legal | Manual compliance checks are time-consuming and error-prone. | Automate regulation mapping and compliance validation workflows. | Reduced audit effort, faster compliance validation. | • Audit Prep Time ≤ 50% • Compliance Gaps ≤ 5% | Streamlines internal audits and boosts regulatory readiness. | Scattered documents and ad hoc validation steps. | Peers use NLP for compliance document tagging. | Compliance Manager- configures rules Legal Analyst- reviews outputs. | Rule-based tagging, compliance rule engine, alerting module. | Traceability, access logs, audit trails. | Doc Parser ? Rule Evaluator ? Compliance Dashboard | Python, spaCy, Elasticsearch, PostgreSQL | Risk: Missed regulations – Mitigate with human-in-the-loop reviews. |

| Early Warning System for High-Risk Borrowers | UC-005 | Priya Sharma | 13-May-25 | Credit Risk / Loan Servicing | Late detection of high-risk borrowers leads to increased NPAs. | Use behavioral patterns to flag borrowers likely to default. | Timely interventions, reduced NPA rates. | • Default Prediction Accuracy ≥ 90% • NPA < 3% | Aligns with credit risk mitigation strategy. | Static monitoring rules miss behavioral red flags. | CreditTech startups use behavioral AI scoring. | Loan Officer- monitors alerts Data Analyst- tracks risk indicators. | Behavioral scoring engine, alert triggers, account tracker. | Scalability, alert sensitivity tuning, GDPR compliance. | Behavior Data Ingestion ? Scoring ? Alert Engine | Python, scikit-learn, Airflow, PostgreSQL | Risk: Over-alerting – Mitigate with threshold tuning and feedback loops. |

Once a use case is fully enriched, the next step is to prioritize it among other candidates. In the Prioritization & Approval phase, teams apply structured scoring models to rank use cases and finalize which ones are ready to enter development.

|

What's next? Prioritization and Approval |