Discovery: Turning Ideas into Validated Opportunities

The Use Case Discovery phase marks the starting point of Calibo’s DBIM. Its primary purpose is to help teams identify high-impact opportunities that align with strategic business priorities. This phase ensures that all proposed use cases are tied to well-defined goals and objectives, address a validated business need, and have a clear value proposition supported by key stakeholders.

Discovery also emphasizes the importance of building upon prior knowledge by reusing existing use cases or digital assets wherever possible. This reduces redundancy, accelerates innovation, and creates a structured pipeline for further refinement.

The table below outlines the key goals and expected outcomes that guide this phase and ensure alignment with business value, feasibility, KPIs, and strategic direction.

|

Goals |

Outcome |

|---|---|

|

|

Practitioner Guidance: How to Run a Successful Discovery Phase

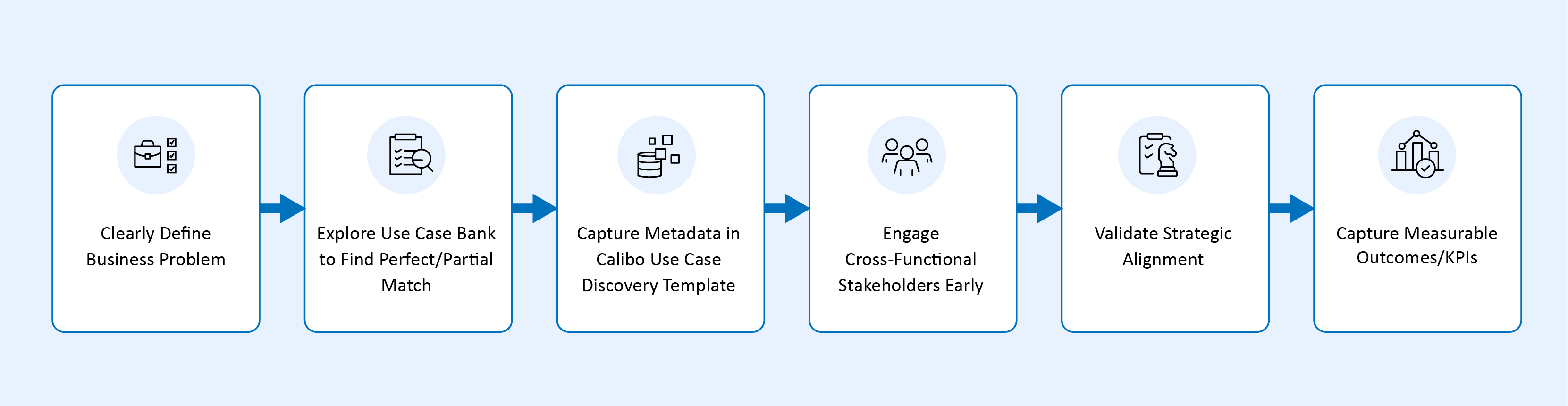

The Discovery phase sets the foundation for successful innovation. The following practical guidelines are designed to help teams navigate this phase with clarity, ensuring that each use case idea is grounded in business need, aligned with strategic goals, and ready for deeper evaluation. These steps make the Discovery process repeatable, scalable, and aligned with the core principles of Calibo’s DBIM.

Before jumping to “what tool to use,” clearly define the problem you're solving, for whom, and why now. Jumping straight to tools (say AI, NLP, or blockchain) without clarity on the problem often leads to mismatched solutions, bloated costs, and underwhelming outcomes. Starting with the business problem ensures that technology serves the outcome, not the other way around.

Example: Instead of “We want to use NLP,” say “We are unable to track customer sentiment from reviews in real time, delaying product feedback cycles.”

Use these prompts during workshops or stakeholder interviews to get clear, specific, and actionable inputs. They help shift the focus from vague ideas to grounded needs.

-

What is broken, inefficient, or slow?

-

Who is affected and how?

-

What is the cost of inaction?

Always begin with a search in the Use Case Bank (UCB) using keywords related to your problem.

-

If a perfect match is found → reuse it or enhance it.

-

If a partial match is found → assess which components can be reused.

-

If no match, create a new entry using the Calibo Use Case Bank Template.

This reduces duplication, accelerates ideation, and reuses proven patterns.

Calibo provides a Use Case Discovery Template with predefined fields to help teams organize ideas and ensure all required metadata is captured:

-

Use Case Title and Industry/Domain

-

Problem Statement

-

Goals and KPIs

-

Stakeholders/Personas Involved

-

Initial Feasibility Check

-

Search outcomes from UCB, Asset Repository, Marketplace

Use the following Calibo Use Case Discovery Template during team workshops or 1:1 interviews with stakeholders.

| Use Case Title | Industry | Business Function / Domain | Problem Description | Current Challenges | Impact on Business | Who is Affected? | Business Objective | Expected Benefits / Value | Relevant KPIs / Metrics | Strategic Alignment | Searched in Asset Repository? | Searched in Marketplace? | Similar Use Case Found? | Gap Identified? | Business Owner | Product Manager / PO | Business Analyst | Architect / Tech Lead | Compliance / Legal | End Users / SMEs |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sentiment Analysis of Customer Product Reviews | Banking/Fintech | Customer Service & Experience | Inability to extract actionable insights from large volumes of customer product reviews across multiple platforms. | Manual review is time-consuming, inconsistent, and lacks scalability. Feedback loops are delayed. | Delayed product improvements, reduced customer satisfaction, loss of competitive edge. | Product Managers, Marketing Team, CX Analysts, End Customers | Automate review analysis to understand customer sentiment in real-time. | Faster feedback cycles, improved product decisions, higher customer satisfaction. | Sentiment score trends, % reduction in manual analysis time, response time to feedback. | Supports the digital feedback strategy and real-time customer insights initiative. | Yes Found generic NLP pipeline templates | Yes No exact fit, but text classification model exists | Yes ID: UCB-NLP-1003 (Social Media Sentiment Analysis) | Yes Need for domain-specific model tailored to product reviews | Y | Y | Y | Y | N | Y |

-

Include Product, Data, Engineering, Compliance, and Business teams from the beginning.

-

Gather their inputs on:

-

Pain points

-

Success metrics

-

Feasibility blockers

-

Stakeholder expectations

This prevents misalignment later and ensures faster buy-in during prioritization.

-

-

Map the use case to your portfolio themes, strategic initiatives, or OKRs.

-

Ask: Does this use case support the enterprise business & digital goals, regulatory mandates, or growth targets?

Example: A sentiment analysis use case directly supports “Customer-Centric Digital Banking” initiatives.

Define measurable outcomes up front, such as:

-

Reduction in turnaround time

-

% improvement in accuracy or compliance

-

Customer satisfaction gains

-

Cost savings

These KPIs will be used in the Rationalization and Prioritization phases.

Checklist for Readiness

PRO TIP

Start with the business pain, not the tech stack.

Clearly articulate the customer or business problem before jumping into solution mode. This helps avoid scope creep and ensures solution relevance.

Don’t aim for perfection in the first round. Discovery is iterative. Some gaps are acceptable.

Before advancing to the Use Case Rationalization phase, teams must ensure all foundational details are locked in. Here's your Discovery checklist that serves as a quality gate and helps you ensure alignment, clarity, and shared understanding. Think of it as a pre-flight check: once all systems are green, you're ready to move ahead.

The questions and pointers provided are for guidance purposes—you are encouraged to customize this checklist to suit your organization’s innovation governance, compliance, and delivery models.

|

Sl. No. |

Item |

Status (Y/N/NA) |

Comments |

|---|---|---|---|

|

1 |

Clearly defined problem statement and business need |

Y |

|

|

2 |

Strategic alignment with business or customer goals validated |

Y |

|

|

3 |

Business impact, benefits, and outcomes outlined |

Y |

|

|

4 |

Key personas, stakeholders, and impacted users identified |

Y |

|

|

5 |

KPIs and measurable success criteria defined |

Y |

|

|

6 |

Discovery form completed and reviewed |

Y |

|

|

7 |

Prior art check: search conducted in Use Case Bank, Asset Repository, Marketplace |

Y |

|

Discovery in Action at Advance Bank

After identifying potential ideas through the Use Case Bank, the leadership team shifted their focus to discovery—evaluating the business need, outlining expected value, and checking for alignment with strategic goals.

Instead of operating in isolation, team members collaborated cross-functionally to validate their ideas, using Calibo's discovery framework to capture critical information like problem statements, business objectives, KPIs, and affected personas.

Martha Grace, the CPO, wasn't the only one getting started. Others on the leadership team were just as energized. Together, these discoveries formed the initial backlog of use cases ready for rationalization.

Here’s a sample discovery phase entry using the template shared above.

| Use Case Title | Industry | Business Function / Domain | Problem Description | Current Challenges | Impact on Business | Who is Affected? | Business Objective | Expected Benefits / Value | Relevant KPIs / Metrics | Strategic Alignment | Searched in Asset Repository? | Searched in Marketplace? | Similar Use Case Found? | Gap Identified? | Business Owner | Product Manager / PO | Business Analyst | Architect / Tech Lead | Compliance / Legal | End Users / SMEs |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Real-Time Fraud Detection using Behavioral Signals | Banking/Fintech | Fraud & Risk Management | Difficulty detecting complex fraud patterns in real time due to reliance on static rules. | High false positives, reactive mitigation, and latency in fraud response. | Financial loss, compliance risks, and damaged customer trust. | Fraud Analysts, Compliance Teams, Security Officers | Detect fraudulent activity in real-time using behavioral analytics and anomaly detection. | Reduction in fraud losses, improved fraud detection accuracy, faster investigations. | Fraud detection rate, false positive rate, average fraud investigation time | Enhances digital trust and supports proactive fraud mitigation strategy. | Yes Found pattern recognition models | Yes No ready-to-use pipeline available | Yes Real-time transaction scoring | Yes Need for contextual behavioral analytics | Y | Y | Y | Y | Y | Y |

| Social Media Sentiment Trends | Banking/Fintech | Marketing & Customer Intelligence | Lack of visibility into brand perception across social channels. | Manual monitoring, unstructured data, slow feedback loops. | Missed opportunities to engage, poor brand crisis response. | Marketing, CX Leaders, Brand Managers | Track and analyze customer sentiment in social media in near real-time. | Faster campaign feedback, proactive brand risk management. | Sentiment shift rate, social engagement score, brand NPS | Supports real-time market sensing and proactive CX strategy. | Yes NLP pipelines available | Yes Found partial Twitter classifier | Yes Text classification engine | Yes Needs integration with multiple social platforms | Y | Y | Y | Y | N | Y |

| Early Warning System for High-Risk Borrowers | Banking/Fintech | Credit & Risk | Reactive credit risk decisions based on outdated or static data. | High delinquency, delayed interventions, limited risk insights. | Loan defaults, strained collections, increased provisioning. | Risk Officers, Credit Underwriters, Collections Team | Identify and monitor borrowers at early risk of default using transactional and behavioral data. | Reduced defaults, improved early interventions, lower risk exposure. | Delinquency rate, days past due, pre-delinquency interventions | Supports predictive credit risk management and better NPA control. | Yes Scorecard templates found | Yes Found customer churn predictor | Yes Loan default early signal model | Yes Need enhanced financial behavior clustering | Y | Y | Y | Y | Y | Y |

| Audit Trail for CI/CD Deployment | Banking/Fintech | IT Governance / DevOps | Lack of centralized visibility into deployment activities across environments. | Traceability gaps, compliance risks, inefficient debugging. | Security concerns, delayed incident resolution, audit failures. | DevOps Teams, Security Engineers, IT Auditors | Implement a unified audit trail system for all CI/CD pipeline stages across environments. | Improved compliance, faster root cause analysis, better traceability. | Pipeline traceability %, time to debug, audit readiness score | Supports compliance automation and DevSecOps best practices. | Yes GitOps pipeline models found | Yes Deployment monitor utility exists | Yes CI/CD visibility dashboard | Yes Requires enterprise-grade audit extension | Y | Y | Y | Y | Y | Y |

| Sentiment Analysis of Customer Product Reviews | Banking/Fintech | Customer Service & Experience | Inability to extract actionable insights from large volumes of customer product reviews across multiple platforms. | Manual review is time-consuming, inconsistent, and lacks scalability. Feedback loops are delayed. | Delayed product improvements, reduced customer satisfaction, loss of competitive edge. | Product Managers, Marketing Team, CX Analysts, End Customers | Automate review analysis to understand customer sentiment in real-time. | Faster feedback cycles, improved product decisions, higher customer satisfaction. | Sentiment score trends, % reduction in manual analysis time, response time to feedback. | Supports the digital feedback strategy and real-time customer insights initiative. | Yes Found generic NLP pipeline templates | Yes No exact fit, but text classification model exists | Yes ID: UCB-NLP-1003 (Social Media Sentiment Analysis) | Yes Need for domain-specific model tailored to product reviews | Y | Y | Y | Y | N | Y |

| Credit Scoring Engine using Alternative Data | Banking/Fintech | Lending & Credit Risk | Traditional credit scoring excludes unbanked/underbanked users due to lack of formal credit history. | Over-reliance on credit bureaus; limited view of borrower risk profile; exclusion of large customer segments. | Missed lending opportunities, higher default risk, regulatory pressure for inclusive finance. | Credit Analysts, Underwriting Team, Data Scientists, Loan Officers | Create alternative scoring model using digital footprints, payment history, social and behavioral data. | Increased credit access, better default prediction, broader customer base. | Approval Rate for First-Time Borrowers, Default Rate Reduction, Credit Inclusion Index. | Supports financial inclusion goals and risk-based pricing initiatives. | Yes Found scoring template based on telco data. | No Not available. | No | Yes No existing use case or model tailored for underbanked customer segments. | Y | Y | Y | Y | Y | Y |

| Automated Regulatory Compliance Tracker | Banking/Fintech | Compliance & Legal | Manual tracking of changing regulatory policies is error-prone and delays impact assessment. | High risk of non-compliance, delayed reporting, manual effort for mapping new laws to impacted systems. | Regulatory fines, reputational damage, operational inefficiency. | Compliance Teams, Legal Counsel, Risk Officers, Regulatory Reporting Teams | Track and parse regulations using NLP to map requirements to impacted internal policies/systems. | Improved compliance posture, faster impact analysis, reduced manual effort. | Regulatory Impact Analysis Time, Compliance SLA Adherence, # of Manual Tasks Reduced. | Aligns with governance modernization and risk mitigation strategy. | Yes Found policy mapping rule framework. | Yes Regulatory change alert system available. | Yes ID: UCB-REG-2019 (Legal Compliance Tracker) | Yes Need real-time parsing and mapping of regulatory clauses to impacted business rules. | Y | Y | Y | Y | Y | Y |

| Early Warning System for High-Risk Borrowers | Banking/Fintech | Credit Monitoring & Collections | Loan delinquency often discovered late due to lagging indicators and weak borrower behavior insights. | Reactive collections process, poor credit health prediction, limited behavioral data utilization. | Rising NPAs, operational inefficiency, low recovery rates. | Credit Risk Teams, Loan Servicing Units, Collections, Portfolio Managers | Build machine learning model using behavioral signals and repayment patterns to flag early risk signs. | Proactive interventions, reduced NPAs, optimized collections. | NPA % Reduction, Days Past Due (DPD) Improvement, Risk Alert Accuracy. | Supports risk-based credit lifecycle monitoring and automation. | Yes Found delinquency prediction models from small loan portfolios. | No | No | Yes Requires integration of repayment timelines, behavior insights, and alerts. | Y | Y | Y | Y | N | Y |

What’s Next:

With problem statements clarified, KPIs defined, and similar use cases identified or captured, the Discovery phase is complete. The next step—Rationalization—will filter and score these ideas based on feasibility, value, and strategic alignment, helping teams focus only on what matters most.

|

What's next? Use Case Rationalization |